In this filecoin price prediction 2030, we will analyse the price patterns of FIL by using accurate trader-friendly technical analysis indicators and predict the future movement of the cryptocurrency.

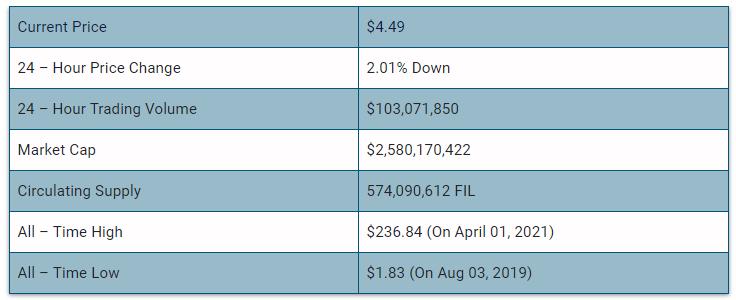

Filecoin (FIL) Current Market Status

What is Filecoin (FIL)

Filecoin (FIL) is the native cryptocurrency of the Filecoin blockchain. Filecoin is an open-source, decentralised storage protocol that exists on top of the InterPlanetary File System (IPFS). Filecoin (FIL) was launched in an ICO in 2017, whereas the Filecoin mainnet went live in October 2020. Filecoin was developed by Protocol Labs.

Filecoin enables users to store any size of data on multiple hack-proof storage providers or devices. It serves as a better alternative to the existing cloud storage providers such as Dropbox, Google (NASDAQ: GOOGL) Drive, and Amazon (NASDAQ: AMZN) S3. Filecoin deploys proof-of-replication (PoRep) and proof-of-spacetime (PoSt) consensus mechanisms to secure the blockchain.

Miners use these consensus models to verify the data that is being stored on the blockchain. They require only GPUs, CPUs, and hard drives for mining. Filecoin nodes act as storage nodes. Filecoin (FIL) is given out as mining rewards and also as rewards to users for renting out space for storage.

2030 FIL Price Prediction

Lowest Prediction: $0.059

Average Prediction: $0.227

Maximum Prediction: $0.730

By 2030, the forecast turns downright brutal. With an average price prediction of $0.227, FIL could experience a 73.51% decline from today’s price. That’s not just underperformance, it’s a total price collapse.

This bearish scenario assumes token inflation continues to outpace utility. If FIL can’t create meaningful demand or newer, faster or cheaper competitors dominate the decentralised storage market, there may be no reason for the token to hold value. Worse, if regulators start cracking down on utility tokens with weak real-world traction, it could accelerate the downward spiral.

On the other hand, if FIL is somehow still standing and managing token emissions better, this forecast might be overly pessimistic. But unless there’s a major pivot or breakthrough, 2030 could be a tough year for holders.

Reasons to Invest in Filecoin (FIL)

Filecoin still represents one of the boldest bets in crypto infrastructure. It’s not chasing trends, it’s trying to build a decentralised alternative to AWS, Dropbox and Google Cloud. If Web3 grows up and starts caring about real decentralisation, Filecoin’s massive storage capacity and global node network could finally shine.

Its core thesis: replacing centralised cloud storage with cryptographically verified, user-run infrastructure is still compelling. And if developers begin to build storage-heavy applications like decentralised YouTube, generative AI models or edge computing platforms, Filecoin could become the go-to backend.

Factors that Can Slow Filecoin’s Growth

But here’s the kicker: all that potential hasn’t yet translated into explosive demand. Despite its tech, Filecoin struggles with adoption, complex onboarding and a token model that’s hard for average users to understand. It also faces fierce competition from Arweave, Crust, Sia and even centralised platforms offering cheaper and faster storage.

Another issue is token inflation. Without strong mechanisms to reduce circulating supply or create meaningful utility, FIL risks becoming a high-supply, low-demand coin. If Filecoin doesn’t shift gears or deliver real value to dApps, it could slowly fade into irrelevance.

Price Prediction Methodology

To build this price outlook for Filecoin (FIL), we analysed a combination of sources and metrics, including short-term resistance levels and long-term adoption trends.

1. Aggregate Analyst Forecasts

Price predictions were sourced from reputable crypto forecast platforms like WalletInvestor and CoinCodex. These provided low, average and high targets for each year and formed the basis for our annualised ROI estimates.

2. Market Trends & Adoption Analysis

FIL’s price depends heavily on whether decentralised storage becomes a foundational Web3 need. If enterprise adoption kicks in or new dApps build directly on top of Filecoin, token demand could surge.

But if the market continues to favour centralised solutions or more efficient alternatives, FIL could underperform.

3. Technical & Fundamental Analysis

Based on WalletInvestor, here are the current support and resistance levels for FIL:

Resistance Levels: R3: $2.956, R2: $2.866, R1: $2.797

Pivot Point: $2.707

Support Levels: S1: $2.638, S2: $2.548, S3: $2.480

Traders should watch the $2.866 –$2.956 range for a potential breakout. On the downside, a break below $2.548 could set off a bearish retracement toward $2.48 or lower. These levels will be crucial for navigating FIL’s next price cycle.

4. Macroeconomic Factors

As with all altcoins, FIL’s fate will also be influenced by broader market trends like interest rates, institutional appetite, risk-on sentiment and global regulatory clarity.

In a bullish macro environment, infrastructure tokens like FIL tend to outperform. But in a risk-off climate, even solid fundamentals may not be enough to hold the line.

Bottom Line

Filecoin price prediction 2030 suggests Filecoin may average around $0.227, with a high estimate of $0.730 and a low of just $0.059.

These numbers reflect a bearish long-term outlook driven by concerns over token inflation, lack of explosive adoption and potential regulatory headwinds. Unless the project pivots or sees a surge in utility, FIL could face a great decline in value over the decade.